Apollo vs Lusha vs Redrob: Which Prospecting Tool Wins for Value?

Himanshi Gupta

Jul 30, 2025

One sales leader asked a simple question during a pipeline review.

“Why are we doing everything right and still missing meetings?”

The team had good reps. The messaging was tested. The budget was approved.

Yet replies stayed low, research took too long, and outbound felt heavier every month.

This is where most teams are today.

Choosing the right prospecting platform is no longer about who has the biggest database. It is about timing, intent, accuracy, and how fast teams can move without burning hours.

That is why this Apollo vs Lusha vs Redrob breakdown matters.

This is not a feature dump. This is a value-focused comparison for teams that care about pipeline quality, not just activity.

Core Comparison: Database, Signals, AI Workflows & Execution

Below is a practical, outbound-focused view of Apollo vs Lusha vs Redrob - how these tools stack up on the factors that decide “value” in the real world.

Category | Apollo | Lusha | Redrob |

Core positioning | Unified AI sales platform used by a very large customer base | Data + enrichment + buying signals, positioned around trust and compliance | “From search to send” outbound system with smart intent targeting and verification |

Contact + company coverage | Large network; Apollo AI references 265M+ contacts | Lusha positions 280M+ contacts (and “verified” contact focus) | 700M+ global profiles, verified across 19+ sources |

Verification | Depends on workflow and plan; strong enrichment ecosystem | Strong emphasis on verified data and enrichment | 98% deliverability claim via verification across 19+ sources |

Intent/signals | Apollo AI mentions buying signals and real-time research support | Real-time intent signals and buying committee visibility positioning | Smart intent filters and high-intent signals like funding, hiring, expansion |

AI search + productivity | Apollo AI supports natural language list pulls and research | AI workflows positioned around enrichment + GTM automation | Natural language lead search + AI understands context and intent |

Outreach execution | Strong engagement story; sequences and automation implied in platform messaging | Strong “data layer” angle; outreach depends on integrations and workflows | Automated email sequences included on Redrob plans |

If “value” means fewer moving parts, less data waste, and faster execution, the biggest differentiator is whether teams can combine intent → verified contact → outreach in a single workflow. Redrob explicitly positions itself around that “search to send” operating model.

Where the Differences Show Up in Day-to-Day Outbound

1) Data Coverage vs Data Usefulness

Apollo and Lusha have strong market presence and broad datasets, and both emphasize enrichment and GTM workflows in different ways.

Redrob, one of the best B2B prospecting tools, leans into a different promise: verified reachability and buyer readiness, not just contact discovery.

A useful gut-check question…

Are lists being built because “the tool had contacts,” or because those accounts show active reasons to buy?

Redrob’s Smart Filters explicitly spotlight buying signals like funding, executive hiring, and expansion.

2) AI that Reduces Work vs AI that Adds More Steps

While evaluating Apollo vs Lusha vs Redrob, Apollo is clear about natural language list pulling, lead research, and workflow support across research, writing, and engagement.

Lusha positions AI-powered prospecting tools around enrichment workflows and real-time intent signals that keep teams aligned.

Redrob’s AI is designed to remove “filter gymnastics” with natural language search that understands context and intent.

The practical question to ask:

Does AI shorten the path to a qualified list, or does it just change how the same list is generated?

3) Outreach Execution Without Tool-Hopping

If outbound requires exporting, cleaning, enriching, deduping, and then sequencing elsewhere, value gets diluted quickly.

Redrob packages smart search, intent filters, verification, and automated sequences as part of the same stack.

That’s why Redrob, being the best prospecting tool for outbound sales, frames value around time saved and lower cost-per-meeting.

API, Enrichment & Scaling: The Technical Edge that Changes “Value”

RevOps and growth engineering care about match rates, enrichment reliability, and predictable scaling.

Redrob: Unified Enrichment API + Multi-Provider Strategy

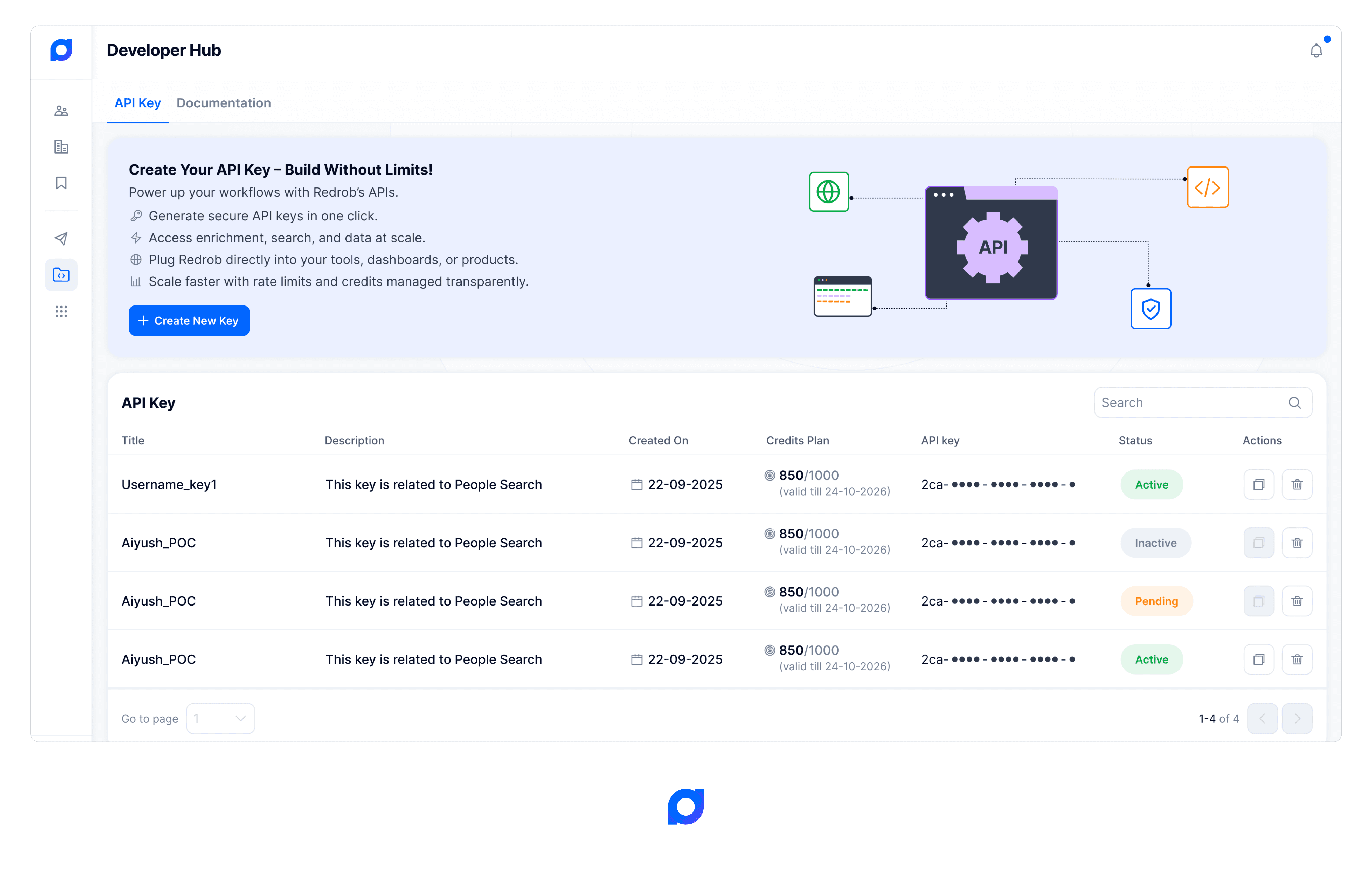

Redrob’s messaging is explicit about a unified API that pulls from 20 providers through one endpoint, with 85%+ match rates positioning. We also state verification across 19+ sources and highlight deliverability outcomes.

What that changes operationally:

fewer vendor contracts to manage

less logic to “waterfall” between providers

one integration surface for CRM, internal tools, or enrichment jobs

Apollo: Robust API Docs & Enrichment Endpoints

Apollo provides published API documentation with endpoints across enrichment, search, accounts, contacts, and more.

That’s valuable for teams building custom workflows - but the end-to-end value still depends on how clean the data is in the workflow that follows.

Lusha: API & Enrichment Capabilities

Lusha supports API-based enrichment as a primary workflow, with credit-based plans that make usage forecasting straightforward.

A practical question for tech teams…

How many systems are being enriched, and how many “single points of failure” exist in the enrichment chain?

Redrob’s “single key” API positioning is designed to reduce that fragmentation. For teams evaluating the Best alternative to Apollo and Lusha, this matters because fewer integrations and fewer handoffs typically mean faster list-to-outreach execution.

Pricing & Value Reality Check: Where Teams Feel the Cost

Pricing gets tricky because usage is credit-based and plan packaging varies. Instead of debating “cheapest,” the better approach is to compare unit economics: cost per verified contact, cost per meeting, and cost per team adoption.

How Pricing Mechanics Affect Value

What you pay for | Apollo | Lusha | Redrob |

User access | Per-seat (more users = higher cost) | Per-seat (more users = higher cost) | Unlimited users (no seat-gating) |

Getting contact data | Credits/usage rules based on plan | Credits to reveal contacts (email/phone) | Verified contact access + fair credits model |

Exporting data out | Export limits/export credits can apply | Usually tied to credit usage | No “locked-in” workflow - built to use data where teams work |

Scaling outbound volume | Costs rise with seats + exports | Costs rise with seat + credits burn | Designed to stay predictable as outreach scales |

Enrichment economics | Enrichment included + governed by limits | Strong enrichment workflows + credit use | Waterfall enrichment across multiple sources reduces repeat spend |

For India-based teams, per-seat pricing can quickly inflate costs when founders, AEs, and SDRs all need access. Redrob’s “unlimited users” approach is a direct value lever for teams that want broad adoption without budget friction.

Which Tool Wins for Each Use Case?

This is the part most comparison posts skip: when evaluating Apollo vs Lusha vs Redrob, teams don’t buy “a database.” They buy an outcome.

Primary need | Apollo fits when… | Lusha fits when… | Redrob fits when… |

High-volume prospecting + broad workflows | A single platform for many motions matters, and the team wants a mature ecosystem | — | Lists need to be smaller but higher intent, with faster execution |

Phone-first outreach + direct dials | — | Phone accuracy and contact reach is a priority | Verified contacts + intent filters matter more than raw dial volume |

RevOps enrichment + developer workflows | Apollo APIs are central to internal systems | Lusha API fits enrichment-driven stacks | One endpoint across 20+ providers reduces vendor complexity |

Early-stage teams needing speed | Setup needs to be lightweight | Budget and credits need tight control | Smart filters + verification + sequences reduce tool-hopping |

LinkedIn-first prospect capture | Chrome extension exists | Chrome extension exists | Chrome extension built around verified emails + list building |

The fastest wins usually come from catching accounts during change - funding, hiring spikes, expansions, and role changes. In a B2B prospecting tools comparison, Redrob’s high-intent filtering is built around that exact moment, which is why it tends to win on value for teams measured on meetings, not list size.

Why Redrob Wins on Value for Modern Outbound

Redrob is built for teams that want fewer tools and better results. In the above B2B sales intelligence tools comparison, the difference shows up fast:

Instead of static lists, Redrob delivers buying signals.

Instead of hours of research, teams spend minutes targeting.

Instead of hiring more BDRs, teams scale meetings with smaller teams.

With Redrob:

Prospecting time drops from 30 hours to under 2 hours per week

Reply rates average above 30%

Cost per meeting reduces by nearly 70%

These outcomes are why Redrob is often chosen after a detailed B2B lead generation software comparison.

More than 5,000 companies already use Redrob to run outbound without burnout.

AI-powered filters, verified data, and unified APIs allow sales teams to focus on conversations that convert.

For teams evaluating B2B sales intelligence platforms with revenue impact in mind, Redrob delivers value where it matters most.

Book a demo and get 10 contacts free.

Frequently Asked Questions

1) How do B2B prospecting tools usually price access to data?

Most tools mix a subscription with usage limits, often credit-based for reveals, exports, or enrichment. In a B2B prospecting tools comparison, map expected prospect volume to credit burn to forecast true cost.

2) Do B2B prospecting tools provide verified emails and phone numbers?

Many B2B sales intelligence platforms offer verification, but standards vary by vendor and region. Confirm real-time validation, bounce protection, and whether direct dials are truly person-specific before scaling outreach.

3) What integrations should a prospecting tool support for outbound teams?

For the best prospecting tool for outbound sales, prioritize CRM sync, clean exports, and enrichment workflows. API access helps RevOps automate de-duplication, standardize fields, and keep routing accurate as records change.

4) How can teams reduce bounce rates when scaling outbound?

In a sales intelligence tools comparison, assess how tools validate emails close to send time. Reduce bounces by avoiding old lists, suppressing catch-all addresses, and continuously refreshing contacts as roles and companies change.

5) When does an enrichment API become necessary?

A B2B lead generation software comparison should factor in API needs once teams enrich large volumes. APIs reduce manual uploads, keep CRM fields consistent, and update contacts as titles, domains, and job moves happen.

6) Does Redrob provide buying signals for outbound prioritization?

Redrob is built around AI-powered prospecting tools that surface intent signals like hiring and expansion. This helps teams prioritize accounts more likely to be in-market, improving relevance and reducing wasted outreach.

7) What does Redrob’s Unified API help with in real workflows?

In a B2B sales intelligence tools comparison, Redrob’s Unified API stands out for enrichment through one endpoint. It supports standardization, improves match coverage, and reduces vendor sprawl when syncing verified data into CRMs.

8) Is Redrob a strong option for India-focused outbound teams?

For the best B2B prospecting tool in India, Redrob supports fast targeting with verified company and contact data plus intent-led filters. It suits teams building pipelines across SaaS, services, and modern B2B categories.